Seven steps every salaried person should know about Tax planning during the month of April. (India)

Introduction

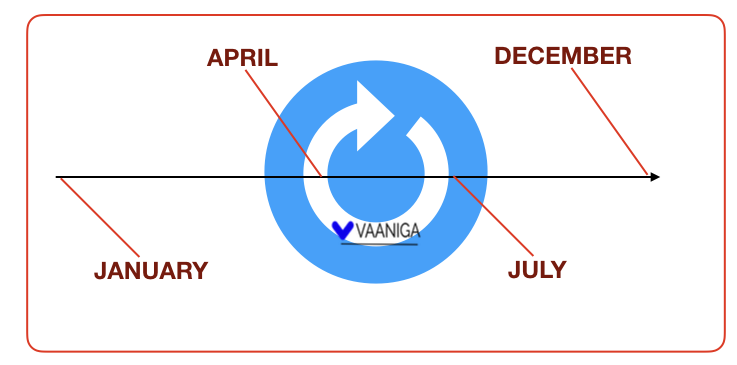

The month of April indicates the start of a new financial year (India). Ideally, the momentum will be high at the initial stages when there is something anew. However, it is not the case for Tax Planning. Most of the salaried people procrastinate their tax planning and the end result is that they worry about the returns and the yield.

In this article, I will cover what needs to be done during the start of every financial year with the proverb in mind “Start Early….”

What most of the employees tend to do during the month of April is to fill all the defaults and submit their tax declaration. Once the reminder comes for tax proof, people will realise the delay in saving the declared amount.

In order to avoid this, start your tax planning early and identify the right source of saving schemes according to your goals.

Let me highlight all the 7 steps that are required for your tax planning. Five steps are sufficient and the rest two are to be completed in the next financial year. However, people tend to delay the last two steps and hence covered it as 7 steps article.

Refer this simple flow chart. Explanation is given below the diagram:

Step 1: Identify Sources of Income

Various channels of income

- Rental Income

- Salary

- Passive Incomes like Savings Bank Interest, Dividends

This step will help you to identify what are the different sources of income other than your salary. It will also help you to figure out the possibilities of saving those additional income (or) investing them wisely.

Step 2: Understand

What is that you have to understand as part of step 2? It’s very simple.

Tax Saving Options

First thing is, what are the different schemes available for saving your hard earned money and each schemes advantage and disadvantage. Are you considering Debt vs Equity (or) Debt (or) Equity (or) other schemes. Please note, let the selection of saving scheme align with your financial plan / financial goals. Following options are available as part of tax planning.

- 80C schemes which includes (LIC, PPF, ELSS, Tuition Fees, 5 years Fixed Deposit)

- 80 D schemes (Example: Medical Insurance premium)

- Housing Loan

| Sections | Category | Instrument | Comments |

|---|---|---|---|

| Sections 80C | Debt | LIC, Fixed Deposit, PPF, NSC | Lock-in period varies |

| Equity | ELSS Mutual Funds | Least lock-in period | |

| Expense | Tuition Fees | Cannot be recovered 😆 | |

| Section 80D | Expense | Medical Insurance | Cannot be recovered 😆 |

| ….. | …. | …. |

Tax Slab

Second thing is, since you have already identified your sources of income you have to understand under which tax slab your employer will deduct tax. There is a catch here. You should be aware that after choosing the savings scheme does your tax slab change or not ?

- 5%, 10%, 30% and above

Step 3: Declare

Once you have identified your saving schemes you have to declare it before your finance team finalises the date for freezing. They might open it every month for updating it, but don’t take this option. Stick to your initial steps (1 and 2).

If you are doing this step wrong, then the impact will be known during the month of January to March. So do it correctly.

Other scenario is, you are already in middle of your financial goals and wanted to declare something new. Example: Your kids school expenses. In that case you can modify your declaration.

Every company will have a way (online portal) to submit the declaration. Lethargic employees will tend to ignore those emails.

Step 4: Save

I assume, you are clear with Step-1 and Step-2 before even you start thinking of saving. Ideal goal should not be only your tax savings, but it also should enable you to achieve your financial goals.

Here is a simple strategy for saving:

- Identify the amount you have declared for your savings. Now, open an RD account during every January and run for 12 months. Start small may be 500/- per month.

- Other way is, you could divide the total amount you wanted for your declaration and divide that by 12 and put that amount in RD every month. For example:

If your total savings is 60000 as part of your 80C, then divide that by 12.

60000/12 = 5000/- ===> You can open an RD account with 5000/- every month.

Why January? Because, most of the companies asks their employees to submit the proof for the tax declaration during January. Few companies do it during December, but let me go with Ideal case of January (Beginning of a new year).

Step 5: Submit Proof

As soon as the month of January approaches, your employer will notify you through the finance team to submit the proof of documents for the declaration you made in Step-3.

This is needed to cross verify the declaration against the actuals. In case if there are discrepancies in the actual vs declaration then the difference in the tax amount will be calculated and deducted in the month of Jan to Mar based on the difference amount.

Typically, most of the employees who don’t have the step-1, and step-2 planned properly will have to face this deductions during month of Jan-Mar.

Example: If you have declared your 80C for 1,50,000 and you are submitting proof for 75000 and PF contribution is 36000/- then the remaining amount is additional income and according to your tax slab your tax will be deducted.

Step 6: File Returns

Form-16 is needed for the employees to file their returns. Hence thoroughly check your form-16 once you get it from your employer. Verify the data as sometimes it might have few in-correct details. Get that corrected as soon as you receive your Form-16. This typically happens during month of June every year.

Government of India, Income tax department has eased the way of filing returns through their online portal. It’s quite easy to follow the steps mentioned in their website ==> Income Tax India

In case if you think it’s complex there are seasonal business consultants who do the returns filing and charge a nominal amount. You can approach them.

Step 7: Acknowledge

Once you finish filing your returns for the corresponding financial year, you have to acknowledge it and the acknowledgement should be finished before the deadline mentioned by Income Tax department of India.

Question here for salaried employees is, Why should I acknowledge my tax returns?

Answer is simple. Look at step-1. We have talked about sources of income. Your employer has deducted Income tax based on your declaration and proof submission. There could be various other sources of income which you might not have disclosed (not intentionally). So your employer is not responsible for that. It becomes individuals responsibility to explicitly mention that.

Hence the acknowledgement, also known as verification is required from an employee perspective. During your return filing process if there are any tax evasion or refunds which are genuine you will be entitled for the same.

ITR-V has to be used for this verification and if it was not digitally signed, you can take a print out and send it to Income tax India office Bangalore address. This procedure is also eased now. Check the official website for more information.

Please note, any delays in doing step 6 and step 7 would attract penalty / fine.

Conclusion

Hope this helps in understanding the income tax planning for salaried employees and how to align your financial goals towards tax planning.